Members

What is an EOB?

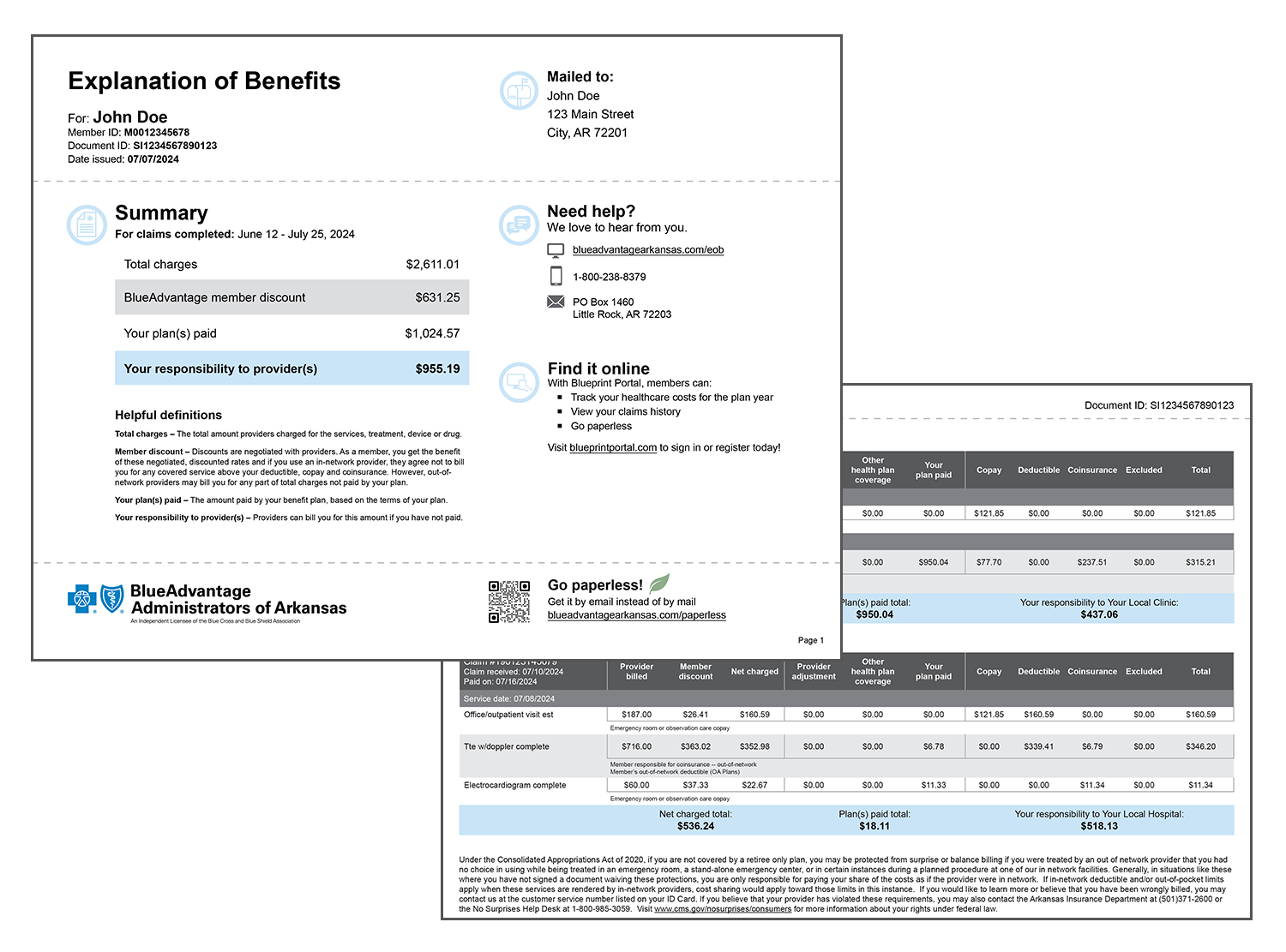

The Explanation of Benefits (EOB) shows the details of your medical and pharmacy expenses and how health insurance covers each. It's a summary of your claims activity that includes:

- Total charge: The total amount a provider charged for the services

- Member discount: Discounts are negotiated with providers. As a member, you get the benefit of these negotiated, discounted rates and if you use an in-network provider, they agree not to bill you for any covered service above your deductible, copay and coinsurance. However, out-of-network providers may bill you for any part of total charges not paid by your plan.

- Your plan(s) paid: The amount BlueAdvantage paid based on the benefit coverage and the contractual agreement with the providers

- Your responsibility: Providers can bill you for this amount, if you have not paid

You may have paid your responsibility already. If not, this is the amount you can expect to be billed from your healthcare provider at some point. You will not receive a bill from us.

EOBs are sent every two to four weeks, depending on your plan type. Each EOB will include any claims processed within that time. You may be able to see information about a claim before your EOB is ready when you sign in to Blueprint Portal.